The Maturity Value of a Note Is the

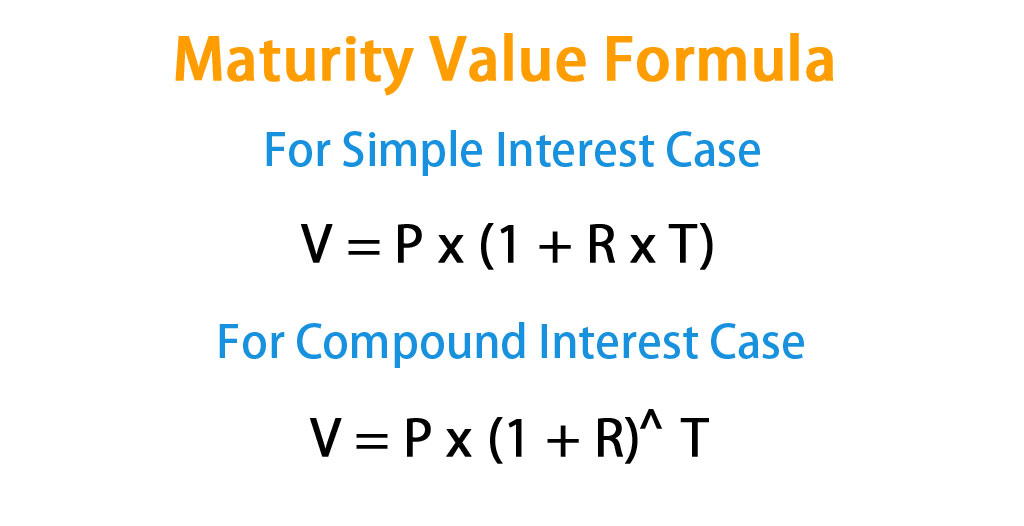

The maturity value formula is V P x 1 rn. Maturity value 102000.

Maturity Value Formula Calculator Excel Template

The maturity value of a note is the ________.

. The maturity value of a promissory note is. It can be expressed as. The maturity value of a 60-day note for 9000 that bears interest at 6 percent is Assume 360 days in a year A 9000.

V Maturity Value. T Time of Investment. Assuming the bond has a 2-percent interest rate 30 years worth of.

The future date is called the maturity date. D principal amount times the interest rate. The allowance method and the direct write-off method.

The principal amount minus interest due B. Find the maturity value of a note for 15000 pesos at 12 ordinary simple interest for 182 days. It is the amount which the company expects to collect from the borrower.

Maturity value Face Vaue Interest. That is the maturity value of the note --. Saying a note has matured is another way of saying that it is due.

What is the maturity date of a loan taken out on September 9 1998 for 125 days. The maturity date for a six-month note issued on January 15 would be ________. Find the amount of interest on a loan of 10500 at 9 interest for 124 days using the exact interest method.

Duration 6 months. The maker may also be obligated to pay a penalty if the payment is not made on the. Has a payable to another party.

A note receivable is a promissory note that grants its holder or payee the notes maturity value at the notes maturity date. Purchases goods on account C. The two methods of accounting for uncollectible accounts receivable are ________.

When you divide multiply and add it up youll find that the maturity value of this note is 102000. Accounting for Discounted Note Receivable. The face value of the note.

R Rate of Interest. Principal amount plus interest due at maturity. The note obligates its maker to pay an agreed-to amount which may be the notes face amount or the face amount plus interest at a certain future date.

Maturity value is the amount an investor will receive in total at the end of a debt instruments holding period. The maturity value of the note would be - ScieMce. A 25 bond that takes 30 years to mature will pay 25 plus accrued interest after 360 months.

C face amount of the note. The face amount of the note D. Calculate the maturity value.

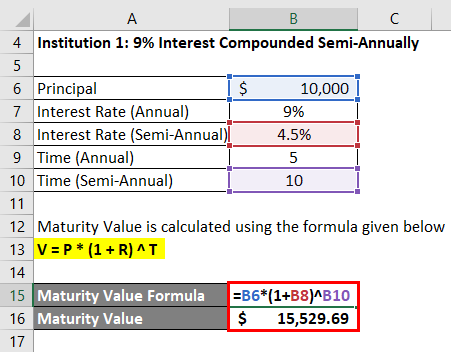

V is the maturity value P is the original principal amount and n is the number of compounding intervals from the time of issue to maturity date. 40000 40000 6 12 8 100 40000 40000 05 008 40000 1600 41600. Maturity value 102000.

The face value of the note 40000. A 6700 85 note is dated April 10 and is due in 75 days. You see that V P r and n are variables in the formula.

What is the maturity date of a loan taken out on September 9 2021 for 125 days. What is the maturity value of a note. Find the maturity value of a note for 15000 pesos at 12 ordinary simple interest for 182 days.

The maturity date of a note is the time and date when the interest and principal is due in full and must be repaid. AskedSep 23 2015in Businessby Andrei. This is the amount that the bank expects to receive on the maturity date.

The maturity value of a note is the ________. The maturity value of the note would be. A creditor is a person or business who.

Find the maturity value of a note for 15000 pesos at 12 ordinary simple interest for 182 days. V P 1 R T. A principal amount minus interest due at maturity.

It includes both principal and interest. Donate your notes with us. A 6700 85 note is dated April 10 and is due in 75 days.

Asked Aug 3 2017 in Business by Mikela. When you divide multiply and add it up youll find that the maturity value of this note is 102000. Bonds that have higher risk levels tend to pay more interest while more conservative bonds pay less interest.

In case of a bond which pays periodic coupon payments the maturity value is basically the par value of the bond. B principal amount plus interest due at maturity. The principal amount plus interest due C.

P Principal Invested. The face value of the note plus the interest due to the maturity date. An investments maturity value is the face value plus any interest.

Heres how to calculate the maturity value of a note and a warning about a quirk in commercial bankers calendars. For example if you have an account that pays 5 percent interest compounded annually with a maturity date in three years and a principal of 1000 the maturity value is V 1000 1 0063 1191016 which normally rounds to 119102. A note or promissory note is a written promise to a pay specific amount of money at a future date.

The principal amount times the interest rate 2. Sheila Spinney borrowed 32500 at 75 simple interest for 180 days on January 7. The maturity value of a 20000 7 75-day interest-bearing note dated september 10 is.

The maturity value of a 60 day note for 9000 that. That is the maturity value of the note --. MV Principal Principal x Interest Rate x Years to Maturity.

Debenture Example Angel Investors Accounting And Finance Business Basics

No comments for "The Maturity Value of a Note Is the"

Post a Comment